February 10, 2026

Trends in Manufacturing Automation

- OEMs and Tier 1 suppliers are facing increasing pressure to enhance their digital maturity, transparency, and operational resilience.

- Automation and AI are moving from pilots to standard practice, reshaping speed, quality, and visibility across plants.

- Human–machine collaboration is accelerating, with cobots and AI assistants supporting higher‑value work and reducing strain.

- Smart factory technologies like IIoT, edge computing, and private 5G enable real‑time visibility and faster changeovers.

- AI‑driven predictive operations reduce downtime, improve quality, and support self‑optimizing production environments.

- Carbon transparency is now a procurement requirement, with product‑level emissions data influencing supplier selection.

- Digital twins and IIoT cybersecurity are becoming core to supply chain continuity and OEM sourcing decisions.

New Demands Shaping Modern Manufacturing

Manufacturers, particularly OEMs and Tier 1 suppliers, face pressure to enhance their digital maturity, comply with increasingly stringent regulations, manage labor shortages, navigate geopolitical uncertainty, and demonstrate transparent, lower‑carbon operations.

Companies that move quickly to adapt to automation and digitization initiatives can see improvements in speed, quality, and operational stability.

Those who hesitate risk falling behind, with widening performance gaps, increasing pressure on margins, and missed opportunities to improve resilience.

The New Reality of Operating in OEM‑Led Networks

The move toward automation and integrated supply networks is redefining how suppliers must operate as they move up the supply chain, take on more responsibility and face higher expectations.

Ambitious goals need to be balanced with the day-to-day realities of running a business.

OEMs are not only raising expectations, they are using these same automation and visibility trends to enhance their own operations, improve planning accuracy, and reduce risk across their global networks.

Suppliers need to manage costs and compliance while demonstrating the transparency, digital maturity, and resilience that OEMs require.

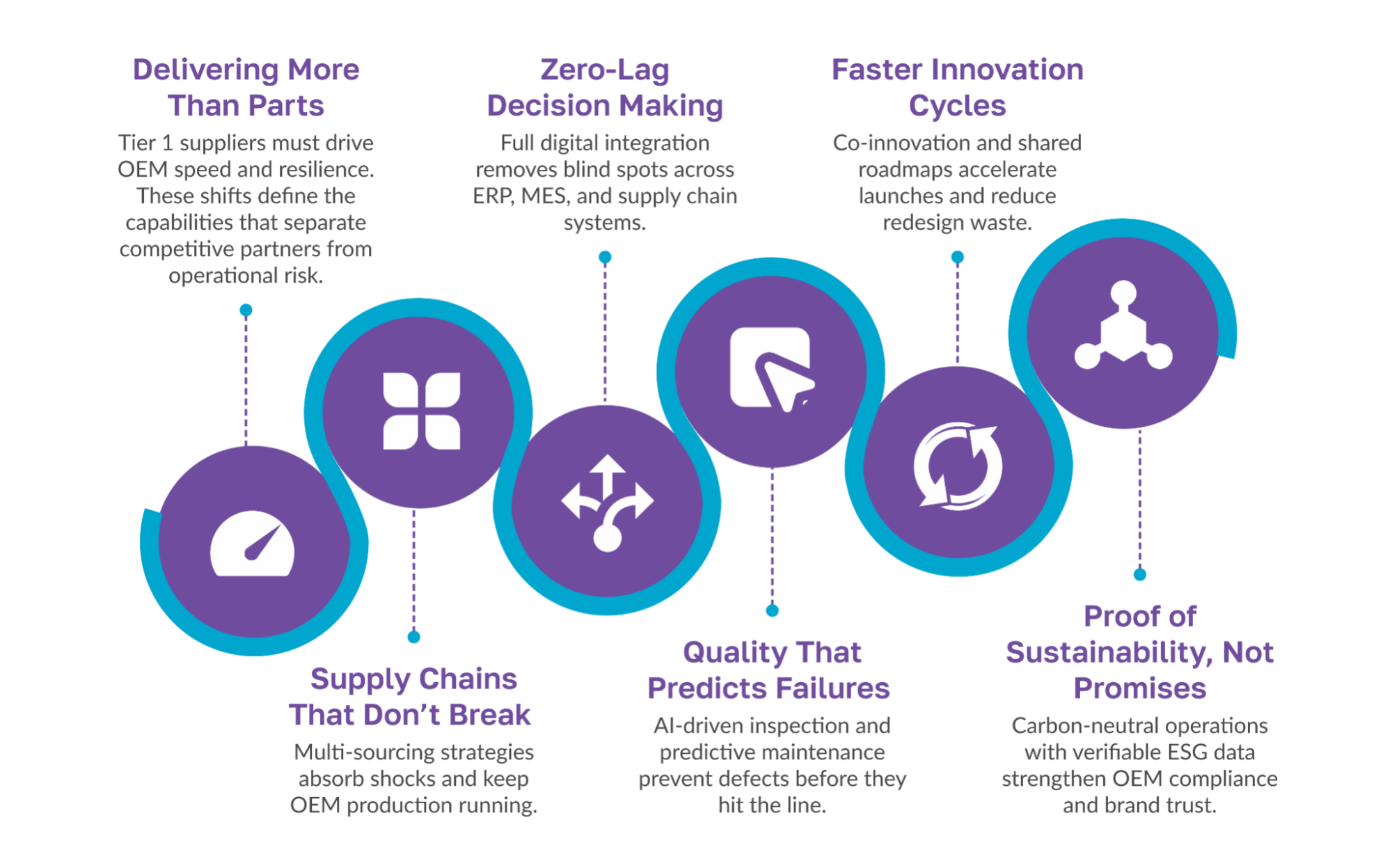

Tier 1 Suppliers Inside the OEM Operating Model

Tier 1 suppliers are now strategic partners, responsible for supporting OEM performance, resilience, and reputation. By 2030, this role will require five key capabilities:

Core Capabilities Required by 2030

- Co‑innovation partnerships with OEMs that share data and development roadmaps

- Full digital integration across ERP, MES, and supply chain systems

- AI‑driven quality assurance and predictive maintenance

- Carbon‑neutral operations with transparent ESG reporting

- Resilient multi‑sourcing strategies that reduce risk

Strategic Implication

A tighter OEM operating model changes how suppliers create value.

Tier 1 suppliers are becoming innovation partners, working closely with OEMs and playing a central role in planning and development.

OEMs benefit directly from this shift because higher digital maturity across their supplier base delivers more precise data, faster response times, and more predictable, flexible production schedules.

Across the supply chain, resilience and transparency are now basic requirements for doing business.

Technologies Defining Manufacturing in 2026

Many manufacturing automation trends that will shape 2026 are already emerging in some factories today. What’s different now is how quickly they are being adopted.

Automation and AI are transitioning from test projects to standard practice, prompting companies to reassess their operations for increased speed, visibility, and resilience.

Human–Machine Collaboration and Workforce Augmentation

Collaborative robots and AI assistants are becoming standard equipment on the factory floor. They work alongside people and adapt to their pace and preferences.

Teams can focus on higher‑value tasks that require judgment and problem‑solving while reducing physical strain.

Manufacturers are redefining job roles so teams spend more time improving processes, supervising production lines, and addressing exceptions rather than performing repetitive manual tasks.

OEMs are adopting these same workforce-augmentation models to reduce ergonomic strain, improve training consistency, and standardize operator performance across global plants.

Strategic Impact: Robotics, AI, and training models that strengthen human capability.

Example

BASF has spent the past several years developing what it calls “augmented operator” models at several chemical production sites. The goal is to shift operators into judgment-based roles while automation handles strain, repetition, and risk.

Smart Factory Trends and Real‑Time Visibility

With IIoT sensors, edge computing, and private 5G networks, manufacturers can now see every part of their production in real time.

This visibility helps reduce inventory, speed up changeovers, and identify bottlenecks that were previously difficult to find.

Adaptive robotics enables reconfiguring lines and quickly switching products, reducing downtime and supporting flexible, data-driven operations.

OEMs use this real-time visibility to coordinate production across sites, align schedules with suppliers, and minimize the cost of quality issues.

Strategic Impact: Connected automation that builds agility and responsiveness.

Example

IIoT sensors and edge analytics on beverage lines track fill levels, cap torque, label alignment, and line speed in real time. Dashboards reveal micro-stoppages and quality drift so teams can adjust quickly.

![]()

AI in Manufacturing and Predictive Operations

Machine learning predicts equipment failures before they occur. Automated defect detection is becoming essential for manufacturers seeking a competitive edge in quality.

Predictive maintenance helps prevent unexpected stoppages and reduces the cost of unplanned downtime. Analytics support real-time decisions to improve throughput and energy use.

OEMs use these predictive models to keep lines running smoothly and verify the reliability of supplier data.

Strategic Impact: AI that supports self‑optimizing operations.

Example

A 2025 study on smart steel plants showed neural network models analyzing real-time data to predict faults and reduce downtime. Earlier warnings helped maintain accurate schedules and operational stability in high-stress environments.

Sustainability and ESG Integration

Sustainability expectations now shape how manufacturers invest, plan, and partner.

Automation systems provide real-time emissions and energy data needed for performance planning.

![]()

Manufacturers use this insight to inform capital investments and evaluate suppliers. Metrics such as emissions per unit produced are part of regular performance reviews.

OEMs increasingly expect Tier 1 partners to demonstrate transparency and credible ESG accountability. Reliable performance earns confidence. Weak results cost suppliers business.

Tier 1 suppliers influence the OEM sustainability profile through accurate emissions data and consistent reporting.

Strategic Impact: Automation that makes sustainability measurable.

Example

Major CPG manufacturers now require verifiable product‑level carbon data in supplier evaluations. Accurate reporting is rewarded with preferred status. Suppliers without transparency risk losing contracts.

Resilience and Cybersecurity in the Supply Chain

Digital twins are central to supply chain planning. Manufacturers use them to simulate disruptions and refine continuity plans long before a crisis occurs.

Securing IIoT networks is now a top priority as cyber threats advance. Plants are implementing segmentation, access controls, and ongoing monitoring.

Continuity has become a key performance metric that affects sourcing and program awards.

Strategic Impact: Automation that strengthens and secures supply chains.

Example

Automotive and heavy-equipment suppliers use digital twin models to test multi-sourcing, logistics rerouting, and buffers for events like port closures. Zero-trust access and anomaly detection protect IIoT environments from cyber disruptions.

Driving These Trends

Manufacturers are not moving in this direction by accident. External pressures are reshaping priorities across the industry.

Key Forces

- OEM expectations for digital maturity and transparency

- Global regulatory pressure related to ESG and carbon neutrality

- Geopolitical and climate disruptions that require resilience

- Labor shortages and demographic shifts

- Investor and customer demand for accountability

Obstacles and Roadblocks

Progress depends on technology and the constraints that come with it. Several roadblocks continue to hinder how quickly organizations can move forward.

- High capital costs for automation and the need for clear payback models

- Cybersecurity vulnerabilities in IIoT networks

- Cultural resistance to human–machine collaboration

- Fragmented regulatory environments globally

- Risk of Tier 2 consolidation and exclusion

Aspirational Trends (Directional, Not Immediate)

A few new ideas are starting to become possible. They are not in use today, but they shape the questions researchers and advanced manufacturers are exploring for the next decade and beyond. These ideas reflect broader Industry 5.0 trends toward human‑centric design.

Instant Manufacturing Through Planetary Barter Networks

Manufacturers can trade extra capacity, materials, or machine time directly, much like peer-to-peer exchanges.

Manufacturers can trade extra capacity, materials, or machine time directly, much like peer-to-peer exchanges.

Each site would act as an independent economic agent, evaluating its own availability, setting terms, and negotiating in real time.

Production resources become flexible, tradable assets rather than fixed, siloed capabilities.

Quantum‑Optimized Supply Chains

Quantum computing could examine the entire supply network at once, skipping step-by-step routing decisions.

Quantum computing could examine the entire supply network at once, skipping step-by-step routing decisions.

Traditional supply chains tend to become more disordered as complexity increases.

In contrast, a quantum-optimized supply chain becomes more efficient with more variables, using complexity to find better solutions.

Emotion‑Adaptive Workplaces

Factories aligned with human-centric Industry 5.0 principles will sense worker stress and automatically adjust lighting, sound, and machine speeds.

Factories aligned with human-centric Industry 5.0 principles will sense worker stress and automatically adjust lighting, sound, and machine speeds.

These mood-aware environments combine advanced computing, ergonomics, and real-time sensing to support well-being and consistent performance.

While these ideas may not be realized by 2030, they already influence innovation roadmaps across the industry.

Digital Maturity Becomes a Supply‑Chain Requirement

Supply chains are tightening, and expectations are rising faster than most organizations can keep up with. Digital maturity, verifiable ESG data, and secure IIoT networks are no longer optional.

These are the criteria OEMs use to decide who moves forward and who gets replaced. Tier 1 suppliers are becoming real partners in planning and development.

Companies like EOSYS help manufacturers build automation and data systems that withstand real-world pressures. As factories move toward human-centered, AI-enabled operations, those who act now will set the pace for the decade ahead.